Sustainability related disclosures

Information pursuant to Article 3 Regulation (EU) 2019/2088

The Disclosure Regulation (Regulation (EU) 2019/2088) introduces sustainability-related disclosure requirements in the financial services sector.

Strategies for the integration of sustainability risks in investment decision processes

A sustainability risk is an event or condition relating to the aspects of the environment, social issues, or corporate governance whose occurrence could potentially have material negative effects on the value of the investment.

The sustainability risks are not depicted as a separate risk type but are included in the existing risk categories because they impact existing risk types to which the investment funds are potentially exposed.

Our product strategy places a particular focus on the integration of sustainability risks in investment decision processes. When introducing new products and improving existing products, we clearly prefer those investment strategies that conform with this strategic orientation. Products being currently offered are proactively evaluated at least once per year and enhanced where possible in terms of integrating sustainability risks in the respective investment strategy.

Procedures for taking the relevant sustainability risks into account have been integrated into EAM’s processes. To determine the manner in which sustainability risks are integrated in investment decisions, the relevant sustainability risks were first identified. Next, the identified risks were “translated” into the existing risk categories and measured and evaluated at this time.

The following relevant sustainability risks were identified:

- Environmental risks relating to mitigating the effects of climate change, adaptation to climate change and the transition to a lower-carbon economy, protecting biodiversity, resource management, waste, and other harmful emissions.

- Social risks relating to working and safety conditions and compliance with recognised labour standards, respecting human rights, and production safety.

- Governance risks relating to the due diligence obligations of corporate managers, measures for fighting bribery and corruption, and compliance with the pertinent laws and regulations.

The identified sustainability risks have been incorporated into the definitions of the risk indicators and ratings. Data from external providers are also used when gathering sustainability‐related data for internal analyses. The external data may be incomplete, imprecise, or unavailable at times. The providers of sustainability ratings also take different influences into account and apply different weightings, meaning that a company that is the target of an investment can have different sustainability scores. There is therefore the risk of a security or issuer being assessed incorrectly. A proprietary rating model called ESGenius is used to limit this risk. In this rating model, the predominant sustainability approaches in the market (ethically oriented approach versus a risk view) are combined into an overall view during the analysis. Combining the different providers reduces any data gaps and also verifies the plausibility of the different approaches.

The internal ESGenius platform provides all fund and portfolio managers with access to relevant ESG information on their portfolios and individual securities, and this information can then be taken into account when making the investment decision.

The measurement and assessment of sustainability risks consists primarily of:

- the regular review of quantitative requirements and limits in risk management using

- positive lists and/or

- negative lists

- additional supporting (quantitative) evaluations in risk management for verifying the plausibility of assumptions and further (relevant) information for management

- the review of the processes and documentation as part of the regular OP risk, ICS, and compliance audits

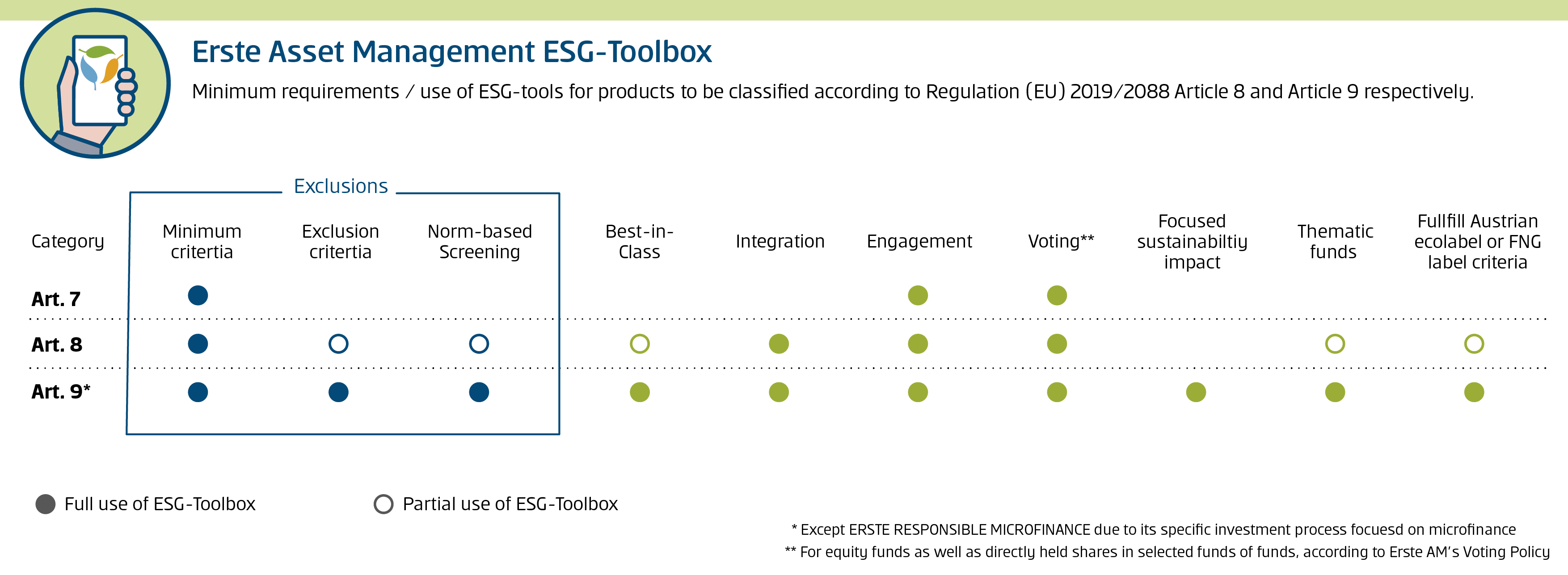

- implementation and publication of relevant stress test scenarios

To manage sustainability risks when making investment decisions, EAM uses an ESG toolbox to address and consider various sustainability impacts and sustainability indicators. Not all elements of the toolbox are used in all investment strategies, rather the use of the individual tools is decided independently for each investment fund depending on the respective investment strategy and the associated expected risk potential. If units in investment funds from other management companies are purchased, funds are generally selected that offer the highest possible level of conformity between the EAM fund and target fund in terms of the most significant adverse sustainability impacts and the sustainability indicators. The number of employed tools can be increased or reduced if regular reviews or current developments warrant this. The following chart provides an overview.

In general, the Management Company may use ESG tools for all of its investment funds to integrate sustainability risks in the execution of its investment process.

Other principles and methods may be used for the special funds issued by the Management Company if third-party management or consulting services are used for these funds. A description of these tools will be provided to the special fund investor in the manner agreed with him.

The Management Company also pays particular attention to sustainability principles in its proprietary investments. Experts from the ESG team are involved in making investment decisions for the proprietary portfolio.

Description of the Erste Asset Management ESG toolbox

Minimum criteria

The minimum criteria for direct investments are the fundamental environmental and sustainability requirements for the Management Company’s investment funds. By substantially limiting investments in coal, we contribute to a shift away from the greatest source of greenhouse gas emissions and to displacing this energy source from the market over the long term. Our minimum standards also include social and ethical principles. A key consideration is the exclusion of controversial weapons (manufacture and sale), which are regulated or prohibited under international conventions because of the immense suffering they can inflict upon the civilian population. These ethical principles also include the exclusion of instruments for speculating on food prices.

Engagement

Engagement means that the Management Company enters into a constructive and targeted dialogue with the companies in which it invests as part of its business activities in order to urge the decision-makers in these companies to employ a sustainable business strategy approach. The Management Company acts directly as well as through investor platforms such as PRI and CRIC and takes part in joint engagement activities through a research services provider. These projects are of a longer-term nature so that they can have a lasting impact on complex sustainable change processes, for example the effective abolishment of child labour.

Voting

The exercise of voting rights is an integral part of the management process. The Management Company exercises the voting rights conferred by the financial instruments that are held directly by its investment funds according to the sustainable EAM Voting Policy, for which it can also commission a voting rights consultant. The objective here is to advocate for a sustainable business approach and the targeted management of individual, particularly relevant ESG risks. If the business approach is not sufficiently sustainable, possible actions include not discharging the management board of a listed company from liability, or voting against supervisory board nominees for the listed company. Solutions for environmental and social issues are formally submitted to the management board of the listed company by voting yes on corresponding shareholder’s motions. Irrespective of ethical, moral, and sustainable interests, this is also in the financial interests of all investors. More detailed information about the voting policy can also be found on the Management Company’s website at https://www.erste-am.at/en/private-investors/sustainability/publications-and-guidelines.

In addition to the fundamental principles above, the following tools can be used for investment funds that promote environmental or social characteristics or a combination of such characteristics pursuant to Article 8 of Regulation (EU) 2019/2088 of the European Parliament and of the Council on sustainability‐related disclosures in the financial services sector (Disclosure Regulation):

Exclusion criteria

The Management Company’s exclusion criteria set strict ethical boundaries. These exclusion criteria serve not only to meet the high ethical requirements of the investors, but to also expressly prohibit investments in socially, economically, and environmentally relevant fields such as nuclear energy, petroleum products, and the generation of electricity from coal due to the associated adverse impacts or risk profile. This makes a direct contribution to improving the social and environmental footprint.

Standard-based screening

Standard-based screening assesses investments for their conformity with certain international standards so as to manage and limit sustainability risks in the portfolio. The exclusion criteria of the Management Company’s investment funds take the relevant international standards into account, ranging from human rights and the International Labour Organization (ILO) standards to the UN Global Compact. Companies that do not adhere to these requirements are strictly excluded to avoid the Fund being complicit in the violation of these international standards.

Best in class

Under a best-in-class approach, ESG criteria are applied to identify the pioneers within a specific sector. This approach allows a sector-neutral investment strategy while partially reducing sustainability risks.

The ESG analysis using the Management Company’s ESGenius model evaluates companies based on their sustainable ESG risk profile. Applying a best-in-class approach limits the investment universe to the best companies from an ESG perspective and ensures compliance with the highest sustainability standards. Over the medium term, this contributes to improving the sustainability management of the companies as all sustainable investors direct the capital flows. The success of this approach is demonstrated by a clear increase in the average rating, especially in the European market.

Integration

The integration and associated reduction of ESG risks in the security selection process improves the risk profile of the respective investment fund through the lower weighting of non-sustainable or less sustainable securities in the portfolio and also ensures that the investment fund makes an active contribution to the avoidance of social and environmental problems. One example is a typically better carbon footprint. The improved risk-adjusted return opportunities that result from integrating ESG risks in investment decisions have been confirmed by a large number of scientific studies.

Theme funds

Theme funds are investment funds that make targeted investments in fields such as energy efficiency, renewable energy, sustainable mobility, the circular economy, and social and development projects. The sustainability-related impact of the respective theme is reported for each of these funds.

The Ecolabel and FNG Label

Some of the Management Company’s funds have attained certification according to the current financial market sustainability standards such as the FNG Label and the Austrian Ecolabel. This independent external assessment and confirmation ensures compliance with prescribed sustainability requirements.

In addition to the tools specified above, the following tool is used for investment funds that promote a sustainable goal pursuant to Article 9 of Regulation (EU) 2019/2088 of the European Parliament and of the Council on sustainability‐related disclosures in the financial services sector (Disclosure Regulation):

Focused sustainability impact

The investment objective of the Management Company’s impact funds is to generate the expected returns while investing in concrete solutions to social and environmental challenges such as climate change. This is intended to achieve a measurable positive sustainable impact. The added environmental or social value that the Management Company’s impact funds create is calculated in detail and depicted in a transparent manner. This information is provided in addition to the company-wide reporting on carbon intensity and the calculation of the water footprint.

Information pursuant to Article 4 Regulation (EU) 2019/2088

Summary

Erste Asset Management d.o.o. (LEI 529900OY10YUOZTM4Z35) considers principal adverse impacts of its investment decisions on sustainability factors. The present statement is the consolidated statement on principal adverse impacts on sustainability factors of Erste Asset Management d.o.o..

This statement on principal adverse impacts on sustainability factors covers the reference period from 01.01.2024 to 31.12.2024.

Management Company , a.s. (hereinafter "Management Company") is together with Erste Asset Management d.o.o. the manager of the managed portfolio. Erste Asset Managementd.o.o. is a financial market participant within the meaning of the Disclosure Regulation as a credit institution that provides portfolio management. Erste Asset Management d.o.o., in cooperation with the Management Company, ensures the provision of information on sustainability in connection with financial products. In the following text, therefore, the main adverse effects of investment decisions on sustainability factors are described from the perspective of the Management Company.

During the period from 01.01.2024 to 31.12.2024, principal adverse indicators of Erste Asset Management d.o.o. are calculated as a 12-month average of end-of-month values.

Companies

Total financed GHG Emissions of company investees amount to 4,595,441.33 tCO2e, among which Scope 1 GHG emissions is 736,555.50 tCO2e; Scope 2 GHG emissions is 92,604.31 tCO2e and Scope 3 GHG emissions is 3,766,281.52 tCO2e. By adopting the equity ownership approach, the methodology allocates emissions to an investor based on levels of capital invested in a company and quantifies a market participant’s responsibility for the GHG emissions of each holding. These metrics measure a portfolio’s GHG emissions allocated to the portfolio in absolute terms, which is dependent on the amount of investment. The higher the percentage holding in a company, the more of its emissions the portfolios own.

Carbon Footprint of Scope 1, 2 and 3 is 467.47 tCO2e/EUR million invested. Carbon Footprint of Scope 1,2 and 3 are 74.87 tCO2e/EUR million invested, 9.43 tCO2e/EUR million invested, and 383.16 tCO2e/EUR million invested respectively. In contrast with total emissions, carbon footprint allows for portfolios comparison on a like for like basis by normalizing the size of portfolios.

GHG Intensity of investee companies of Scope 1, 2 and 3 altogether is 744.87 tCO2e/EUR million sales. GHG Intensity of investee companies of Scope 1, Scope 2 and Scope 3 are 93.96 tCO2e/EUR million sales, 20.47 tCO2e/EUR million sales, and 630.42 tCO2e/EUR million sales respectively. Weighted average GHG Intensity shows investment’s exposure to carbon-intensive companies.

Exposure to companies active in the fossil fuel sector is 3.56 % of total investment. It is worth noting that companies that derive any revenues from exploration, mining, extraction, production, processing, storage, refining or distribution, including transportation, storage, and trade, of fossil fuels are counted in the figure.

Across the investee companies, the share of non-renewable energy consumption and production is 70.09 %.

Energy consumption intensity per high impact climate sector is on average 1.45 GWh/EUR million sales. The sector with the highest energy consumption intensity is transportation and storage, followed by electricity, gas, steam and air conditioning supply. Other high impact climate sector includes agriculture, forestry and fishing,mining and quarrying,water supply; sewerage, waste management and remediation activities,construction,wholesale and retail trade; repair of motor vehicles and motorcycles,real estate activities, the energy consumption intensity of which all remain below 2 GWh/EUR million sales for the period concerned.

Investments in investee companies negatively affect biodiversity-sensitive areas is 2.61 %.

Emissions to water by investee companies is 0.81 t/EUR million invested, while the hazardous waste ratio is 0.90 t/EUR million invested.

With regards to the social principal adverse indicators, the share of investment in companies that have been involved in violations of UN Global Compact principles and Organization for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises is 0.02 %, which reflects a successful integration of sustainability screening criteria in the investment process.

The share of investments in investee companies lacking processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises is 4.73 %.

On gender equality, unadjusted gender pay gap is 15.18 %, while the data coverage remains low at just 25.15 %. Board gender diversity, the average ratio of female to male board members in investee companies, expressed as a percentage of all board members, is 37.29 %.

Exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons) is 0.01 % of investments company-wide

Additional indicators

To complement abovementioned information, two additional indicators that are integrated in the investment process are selected for reporting. The share of investments in investee companies with sites located in areas of high water stress without a water management policy is 5.37 %. During the reporting period, there has been 0 identified case(s) of severe human rights issues and incidents, thanks to the implementation of human rights violation screening and monitoring of investee companies.

Sovereigns

For investments in sovereigns, GHG intensity is 444.73 tones CO2e/EUR million GDP. A total of 5 investee countries are subjected to social violations, representing 4.60 % of all investee countries.

Real Estate

During the reporting period no direct investments into Real Estate were made.

At EAM, the following policies are in place to prioritize the consideration of principal adverse impacts:

While EAM calculates all PAIs that are specified in the SFDR RTS depending on data quality and availability to provide insights to asset management, it focuses on environmental footprint, in particular carbon emission and water consumption, analysis of risks occurring from negative impacts on biodiversity, water stress or from hazardous waste, as well as social factors such as involvement in controversial weapon, respect for human rights, labor standards and diversity matters, anti-corruption, and anti-bribery matters. Moreover, EAM deploys proprietary ESG analysis and scoring to assess the investability of issuers which cover a wider range of sustainability factors than principal adverse impacts and oftentimes are sector specific. Allocation of responsibility for implementation within organizational strategies and procedures The integration of principal adverse impacts in the investment process involves the following parties: Management Board, Chief Investment Officer/Chief Sustainability Officer, Responsible Investments, Investment Teams, Risk Management and Data Management. The Management Board and the Chief Sustainability Officer are responsible for overseeing the sustainable investment strategy and implementation. The Responsible Investments Team acts as the focal point for EAM’ssustainable investment activities and delivers expertise and insights for the investment teams. It is primarily in charge of formulating sustainable investment policies, performing due diligence, making analysis, ESG risks and opportunities, calculating ESG scores, defining investable universe for ESG funds, generating exclusion screens for company as whole as well as for specific funds as well as engaging with investee companies on relevant ESG topics and exercising voting rights according to the responsible voting guideline. Investment Teams for asset classes are responsible for the implementation of ESG strategies, policies, thereby reducing actual and potential adverse impacts, as well as follow up with engagement or divestment where necessary. Based on the research and analysis done by the Responsible Investment Team, Risk Management screens all concerned funds towards compatibility with EAM’s internal ESG standards on a daily basis. Data Management enables data and analysis being available and accessible to all relevant divisions. Through data provided by external partners and the Erste Asset Management’s in-house research capabilities, PAIs are identified and monitored on both a fundamental and quantitative basis. The principal adverse impacts are calculated for EAM as entity and for relevant funds to identify the largest contributors. Methodologies to select the indicators & an explanation of how those methodologies take into account the probability of occurrence and the severity of those principal adverse impacts, including their potentially irremediable character In line with the expectation of OECD Guidelines “Responsible business conduct for institutional investors”, EAM prioritizes its due diligence efforts using a “risk-based approach”. It considers the significance, or severity, of an adverse impact as a function of its scale, scope and irremediable character, which are referred as follows:

Specifically, the risk-based approach recognizes the following factors to prioritize the management company´s due diligence efforts.

Methodologies to identify and assess the principal adverse impacts There are two phases to identify and assess the principal adverse impacts, ex-ante investment, and ex-post investment.

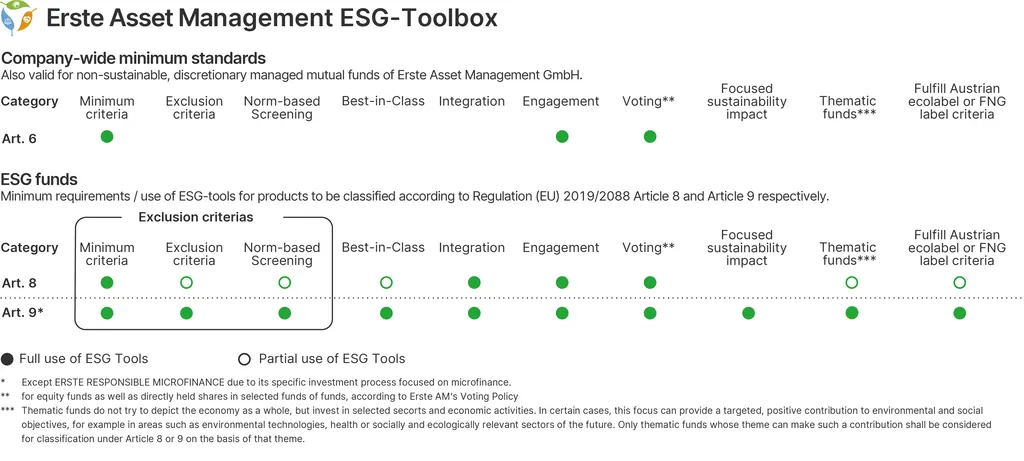

Within portfolios, the selection of principal adverse indicators depends on product strategy and objectives. According to the SFDR, EAM classified three groups of funds, namely, article 6, article 8- EAM ESG Integration Funds and EAM Responsible Funds and article 9 funds- Impact Funds. The classification depends on whether the fund concerned has a sustainable objective and if yes, the extent it incorporates a sustainable investment approach. Consequently, a different set of indicators applies to these groups and individual funds. Built on a companywide exclusion criteria regulated by the EAM Coal Divestment policy, Controversial Weapon Policy as well as the Policy against speculation on food and agricultural commodities that apply to all public funds to reflect the management company´s general ethical standards, ESG Integration Funds are overlayed with additional exclusion criteria including Child Labour, Discrimination, Forced Labor, Human Rights Violations, Military & Weapons, UN Global Compact Violations, and keep a minimum ESG rating of 30 (out of 100) for investee issuers, with data coverage no less than 51% of fund’s NAV. EAM Responsible Funds and Impact Funds use best-in-class approach with the ESG rating threshold of 50 (or the sector specific median) and apply a variety of exclusion criteria depending on the product setting. Details can be found here. ESG research is conducted with EAM´s in-house expertise, with the support of multiple internal and external resources, including company meetings and a range of data providers. Third-party ESG company ratings are systematically incorporated into the management company´s research reports to provide additional context. Currently EAM utilizes ESG information from MSCI ESG Research, ISS ESG Research, Sustainalytics as well as Truvalue-Labs to provide a comprehensive, timely and insightful ESG analysis. Tools EAM uses an ESG toolbox to address different sustainability impacts and sustainability indicators. Not all elements of the toolbox (tools) are used in all investment strategies. Rather, the use of the individual tools is determined on the basis of the investment strategy and the expected risk potential for each investment fund. Where shares in investment funds of other management companies are acquired, the aim is to achieve the highest possible consistency at the level of the acquiring fund with regard to the main adverse sustainability impacts and sustainability indicators. Changes in the sense of an extension or reduction of the tools used are possible, provided that a need arises from the regular reviews or on a case-by-case basis. Below is a schematic representation.

In principle, ESG tools can be used in all investment funds of the management company to take sustainability risks into account as part of the investment process Explanation of the associated margin of error within this methodology As EAM primarily relies on third-party data provider for the raw data to calculate principal adverse impacts, margin of error could arise from the following sources:

EAM recognizes the data limitation and will review carefully in case of abnormality, outliers and abrupt changes and will check the original data source and reports errors to its data provider where identified. Data sources

ESG Research partners of EAM are:

|

||||||||||||||||||||||||||||||||||||||||||||||

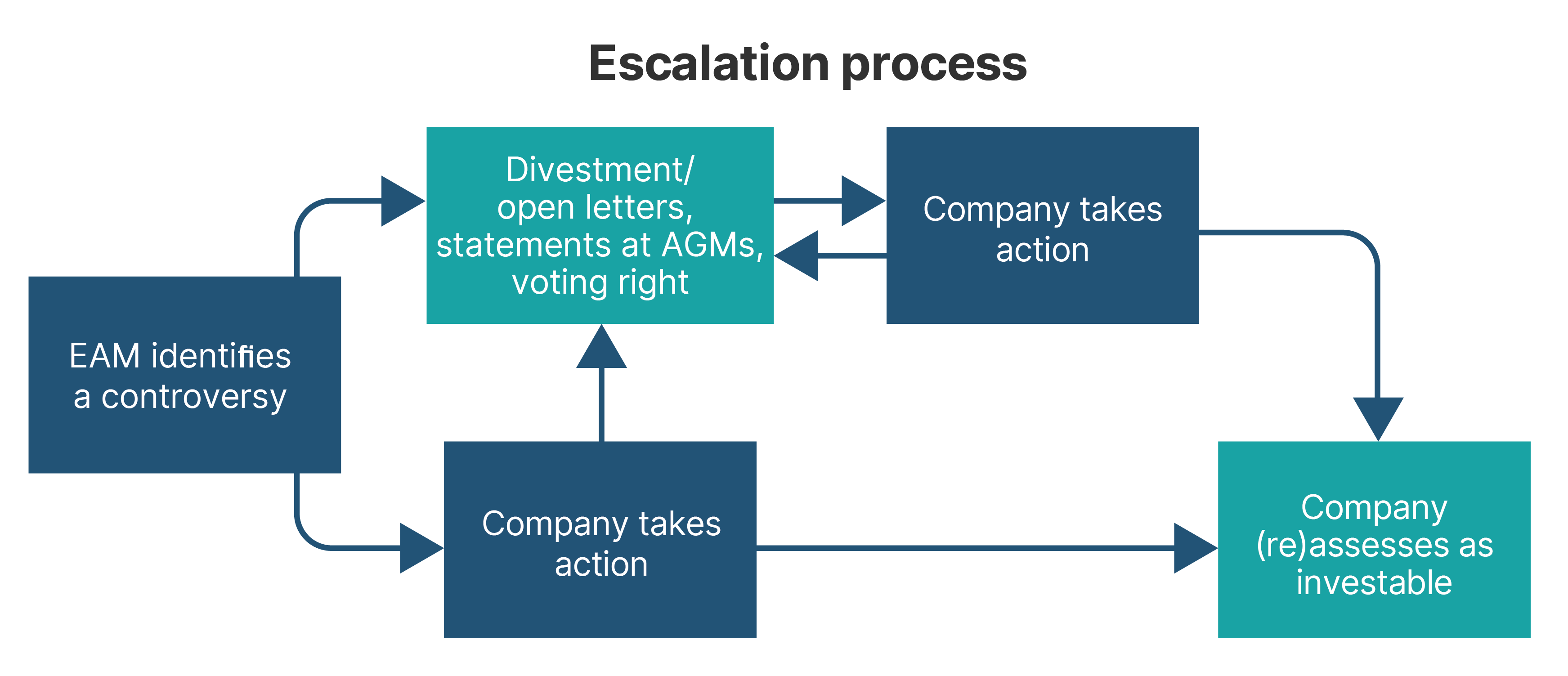

Engagement policies Within the framework of the Principles of Responsible Investments (PRI), EAM regularly enters into collaborations, especially in the field of engagement, to facilitate positive change even within the biggest companies. The goal of EAM’s engagement approach is to achieve maximum changes towards sustainable management in a direct dialogue with companies and on behalf of its clients. This is not only ethically motivated but also because it is the management company’s duty to minimize the ESG risks of its investments while generating new opportunities for its clients. Active OwnershipErste Asset Management understands ‘Active Ownership’ as a key pillar in its investing approach. This means that EAM’s responsibility is not limited to incorporating sustainability criteria into portfolio selection, but also to be an active investor who engages with investee companies, to promote measures that serve social responsibility, environmental protection and enhanced transparency. EngagementAs a committed investor, the management company seeks active dialogue with the management of relevant companies as part of itssustainability process. This exposes weaknesses of the management in handling environmental, social and governance aspects. Furthermore, addressing these issues with companies serves to seek joint solutions for improvement. Engagement is not only a question of responsibility, but also contributes to minimizing risks and thus can improve the long-term investment outlook. Consequently, EAM may excludes companies that fail to show responsiveness. Erste Asset Management employs three engagement strategies:

PAI-focused engagement Within EAM´s engagement activity, it considers the PAI in relation to greenhouse gas emission/ environmental and social matters. Through these engagements, investee companies measure and report relevant information in respect to PAI affecting their businesses. Typically, the objectives of these dialogues on PAI include:

Unsuccessful engagements with companies who have had significant adverse sustainability impacts will be subject to EAM´sescalation process (i.e., open letters, vote against the management, statements at AGMs) and might lead to divestment (see below).

Further information on EAMs Engagement Policy and Reports can be found on the management company´s website. VotingVoting is a central pillar of EAMs Active Ownership approach. Since 2012, the management company has been exercising voting rights for the shares held in EAM's RESPONSIBLE funds in accordance with the EAM voting policy which follows sustainable guidelines Since 2016, EAM extended its voting rights to traditionally managed equity funds. As a result, the voice of investors invested in EAM funds is actively perceived as indirect shareholders of the invested companies. Further information on the voting policy can be found here. To ensure transparency and consistency of voting behavior, the EAM voting portal regularly and publicly reports on voting behavior (here). The plausibility check of the existing guidelines is carried out on a regular basis. Should it be found that no improvement of adverse sustainability effects can be achieved, EAMs engagement strategy will be revised (i.e. the management company´s engagement channels, targeted regions/companies, proxy voting policy, thematic engagement...) and new or additional priorities will be set, to increase its leverage. Such policy adjustments would be written according to PAI and engagement results. |

||||||||||||||||||||||||||||||||||||||||||||||

References to international standards Code of Conduct EAM is committed to the basic values of the legally compliant and ethically sustainable corporate culture and bases its own activities on the EAM Code of Conduct with its binding rules for the daily business life of its own activities. The management company supports several international standards and works together with a diverse range of institutions to make financial markets more sustainable. With collaboration on sustainability issues via these important platforms, EAM contributes actively to help shape the global investment agenda. Erste Asset Management is signatory of:

Erste Asset Management is member/participant of:

Erste Asset Management cooperates with:

Erste Asset Management managed funds (selective) are awarded with:

Erste Asset Management supports the following principles and best practices:

Erste Asset Management complies with:

As of 1 July 2011, Erste Asset Management (EAM) has committed to abstain from investing in companies that can be tied to being active in the area of „controversial weapons“. Controversial weapons are defined as defense equipment whose use and production are rejected due to the excessive suffering they cause and regulated by several international conventions such as:

In addition, Erste Asset Management is a subsidiary of Erste Group Bank AG. Erste Group Bank AG is signatory and member to various international standards and business codes. - Adverse impact indicators used in the assessment of the main adverse sustainability impacts referred to in Article 6 of the RTS (Tables 1-3) to measure such compliance or alignment

The methodology and data used to measure such compliance or alignment, including a description of the coverage, data sources and how the methodology predicts the future performance of the companies in which investments are made EAM utilizes MSCI SFDR Adverse Impact Metrics dataset to calculate the relevant indicators mentioned above along with other datasets provided by third-party providers. The coverage of MSCI SFDR Adverse Impact Metrics is approximately 10.100 equity and fixed income issuers, including constituents of the MSCI ACWI Investable Market Index. Data sources include company direct disclosure, indirect disclosure and direct communication with companies. The calculation method is available here. Currently, the methodology does not predict future performance, due to lack of a wide coverage of reliable data on carbon reduction target and non-comparability of prediction methods with regards to Paris Climate Agreement alignment. EAM proactively contributes to the objective of the Paris Agreement by disclosing carbon footprint for portfolios under the Montreal Pledge. The management company also participated the PACTA program to assess portfolio alignment with different climate scenarios in 2021, and it is an active contributor to the initiative Climate Action 100+. CO2 Footprint EAM actively strives to reduce the CO2 footprint in all areas of the company. For this purpose, scope 1 - 2 emissions are measured in accordance with the Green House Gas Protocol. With appropriate data availability, it is also planned to measure Scope 3 emissions. In addition, the CO2 emissions determined are not only compensated in accordance with international standards, but also actively set and pursued targets to reduce emissions (replacement of business trips by video conferences, switching to public transport for the way to work, reduction of paper consumption, etc.). Degree of alignment of EAM with the objectives of the Paris Agreement EAM is a member of Climate Action 100+. Climate Action 100+ is an investor coalition launched in 2017 and designed for five years. The goal is to help the 100 largest global greenhouse gas emitters reduce their emissions and to motivate the financial assessment of climate risks on their balance sheets and to align their business strategies with the goals of the Paris Agreement. The 100 companies contacted are jointly responsible for about two-thirds of global greenhouse gas emissions. As part of Climate Action 100+, Erste Asset Management has taken the lead in its joint commitment with OMV AG. EAM decided in May 2020 to participate in PACTA 2020. PACTA stands for "Paris Agreement Capital Transition Assessment" and is a model developed by the independent non-profit think tank 2° Investing Initiative for the climate impact assessment of financial portfolios. The aim is to measure the alignment of portfolios with the Paris climate goals. In 2016, EAM signed the PRI Montreal Pledge and since then measures and publishes the CO2 footprint of its equity and bond funds. - predictive climate scenario Predictive climate scenarios are in development and are expected to be implemented until the end of the 1st quarter of 2023. |

||||||||||||||||||||||||||||||||||||||||||||||

Historical comparison A historical comparison will be made available with the publication of the PAI statement in the year 2024. |

Information pursuant to Article 10 Regulation (EU) 2019/2088

Sustainability related product information

The document on information pursuant to Article 10 Regulation (EU) 2019/2088 is conducted for the following funds according to Article 8 and 9 Regulation (EU) 2019/2088.

Please click on the respective fund name to access the document:

Disclaimer

This document is an advertisement. Unless indicated otherwise, data source is Erste Asset Management Ltd. Our languages of communication are Croatian and English. The prospectus (and any amendments to the prospectus) has been published in accordance with the open-end investment funds with a public offering (Official Gazette 44/16, 129/19 i 110/21, 76/22).

Before making a final investment decision, see the prospectus and rules of the fund that are available to all interested parties free of charge, at the management company as well as in all offices of the Depositary. The exact date of the last publication of the prospectus, languages in which the key information for investors are available, as well as information about other places where these documents are available are published on the website www.erste-am.hr.

This document serves as additional information for our investors and is based on the knowledge of the person responsible for preparing it at the time of preparation. Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite.

Past performance is not a reliable indicator of the future performance of a fund. Please note that historical return is not a reliable indicator of the future development of the fund. Please pay attention to the fact that investment in securities other than described seems to bring about the risks. Share price and yield may rise as well as fall.